Car insurance may not be thrilling, but it’s a crucial part of owning a vehicle. It’s designed to protect you financially if something goes wrong, like a crash or theft. Most states require it by law to keep your car legally on the road. But beyond legality, it gives you peace of mind while helping you secure the best auto insurance rate.

The world of car insurance can feel overwhelming. There are so many options, coverage levels, and factors that affect costs. This guide breaks everything down so it’s easy to understand. Whether you’re a new driver or someone looking to update your policy, this article has everything you need to make the best choice.

Why Is Car Insurance Important?

Car insurance is more than just a legal requirement in many states—it’s a safety net that protects you from financial disaster. Whether you’re a new driver or an experienced motorist, understanding why car insurance matters and how to secure the best auto insurance rate is essential. Here’s what you need to know.

1. Legal Obligation

Most countries require drivers to carry car insurance. Without it, you can’t register your vehicle or legally drive on public roads. If caught without insurance, you could face fines, license suspension, or even legal action. It’s simply not worth the risk.

2. Financial Protection in Accidents

Accidents happen, even to careful drivers. Repairs to your vehicle can cost thousands of pounds, and if you’re at fault, you may also need to pay for damages to the other party’s car. Worse, if injuries occur, the medical bills can be overwhelming. With insurance, your policy takes care of these costs, sparing you from potential financial ruin.

- Bodily injury liability: Covers medical expenses for the other driver or passengers.

- Property damage liability: Pays for damage to another person’s vehicle or property.

3. Personal Liability

Without adequate coverage, you might end up paying out of your own pocket if you’re held responsible for an accident. For example, if someone sues you after a collision, you could face hefty legal costs and compensation claims. Comprehensive car insurance reduces this risk, ensuring your assets—like your home or savings—are protected.

4. Protection Against Uninsured Drivers

Did you know that millions of drivers worldwide don’t carry car insurance? If you get into an accident with one of them, it can leave you with unpaid bills. Thankfully, policies like uninsured motorist coverage can protect you in these situations, covering your medical expenses and lost wages.

5. Coverage Beyond Accidents

Insurance isn’t just for crashes. It also helps in unexpected situations like theft, natural disasters, or vandalism. Imagine waking up to find your car damaged by a storm or stolen from your driveway. With the right policy, you can breathe a sigh of relief knowing you’re covered.

- Comprehensive insurance: Protects against theft, floods, and fire damage.

- Collision insurance: Covers repairs to your vehicle, even if you were at fault.

6. Peace of Mind

Having car insurance means you can drive confidently, knowing you’re protected. Even in unpredictable situations, you’ll have support. For instance, I once had a client whose car was struck by a falling tree during a storm. Their insurance policy covered the full cost of the repairs, saving them from a huge expense.

Pro Tip from an Expert

Always review your policy carefully. Many people think they’re fully covered, only to find out they lack important protections when they need them most. For instance, I often remind clients to consider umbrella liability coverage, which provides extra protection for both their car and home. It’s especially useful for those with significant assets or savings.

FAQs About Car Insurance Importance

Q1: Can I drive without car insurance?

No, in most places, driving without insurance is illegal. Penalties can include fines, license suspension, or even impoundment of your vehicle.

Q2: Does basic insurance cover natural disasters?

No, basic insurance typically doesn’t. You’ll need comprehensive coverage for protection against events like floods or fires.

Factors That Influence Car Insurance Rates

Car insurance rates vary widely, and finding the best auto insurance rate requires understanding how insurers calculate your premium. They base it on several key factors, each reflecting the potential risk they take by insuring you. Below, we’ll break these down in simple terms, showing how they impact your costs.

1. Driver Profile

Your age, experience, and driving history shape your insurance rate. Younger drivers, especially teens, usually pay more because they are seen as higher-risk drivers. For example:

- Accidents or violations: Past crashes or traffic tickets may increase your premium.

- Teen drivers: Adding a teenager to your policy can significantly raise costs. Insurers assume they are less experienced and more likely to cause accidents.

Expert Advice: To reduce premiums, consider enrolling young drivers in defensive driving courses. It can lower the insurer’s perceived risk.

2. Type of Vehicle

The car you drive plays a big role in what you pay. Insurers look at repair costs, replacement values, and how risky the car is to drive.

- Expensive cars: Luxury vehicles often cost more to insure because parts are pricier to replace.

- High-performance cars: Sports cars may lead to higher premiums due to their speed and accident risks.

Pro Tip: If you’re buying a car, ask your insurer for quotes on different models. A practical, family-friendly car might cost less to insure than a luxury SUV or sports car.

3. Credit History

In most states, your credit score can impact your premium. Insurers believe that people with better credit scores are less likely to file claims.

- Good credit: May lead to lower premiums.

- Poor credit: Could result in higher rates in states that allow this practice.

Note: States like California, Massachusetts, and Hawaii ban the use of credit scores in setting rates. If you live elsewhere, improving your credit score could save you money.

4. Location Matters

Where you live also affects your insurance cost. Areas with more accidents, extreme weather, or higher crime rates typically have higher premiums.

Examples of Location-Based Risks:

- Traffic congestion: Urban areas with heavy traffic often see more accidents.

- Weather conditions: If your area has hurricanes, flooding, or hailstorms, insurers may charge higher rates.

- Theft rates: Cars in high-crime neighbourhoods cost more to insure due to theft and vandalism risks.

Tip: Consider parking in a secure garage or installing an anti-theft device. Some insurers offer discounts for these safety measures.

5. Local Regulations

State laws affect how much insurers can consider certain factors. For instance, some states require more coverage or ban specific practices like credit checks.

Did You Know? California, New Jersey, and Hawaii offer low-cost insurance programmes for drivers with limited incomes. If affordability is a concern, explore these options.

Key Takeaways

To understand what shapes your insurance rate, remember these factors:

- Your driving habits and history.

- The type of car you own.

- Your credit score (in most states).

- Local traffic, weather, and crime conditions.

- State laws and regulations.

Understanding these points can help you make better decisions. You can save money by improving your driving record, choosing a safer car, and shopping around for the best rates.

Here’s a simple table summarizing the factors affecting car insurance rates:

| Factor | Explanation |

|---|---|

| Driver Profile | Includes age, driving experience, traffic violations, and accident history. |

| Vehicle Type | More expensive, high-performance, or luxury cars typically cost more to insure. |

| Credit History | A good credit score may lead to lower premiums, depending on the state. |

| Location | Traffic, crime rates, and weather conditions in your area can influence rates. |

| Local Regulations | State laws and regulations affect what factors can be considered by insurers. |

This table offers a quick reference for understanding the key elements that insurers use to calculate premiums.

Expert Insights

After 13 years in the auto industry, I’ve noticed that many drivers underestimate how much their vehicle choice affects insurance. A customer once wanted to switch from a Toyota Corolla to a luxury sports car. After running a quote, the insurance jumped by over 50%. When I explained the repair and risk factors, they decided to stick with their Corolla, securing the best auto insurance rate for their situation.

Always ask about potential savings when making life changes, such as moving to a safer area or improving your credit. It could make a noticeable difference in your premium and help you lock in the best auto insurance rate available.

This section ensures that drivers can trace how insurers calculate rates. By being informed, you can take proactive steps to reduce costs while staying covered. Next, learn how to find the best car insurance provider and tailor your coverage to your needs.

How to Find the Best Car Insurance

Finding the right car insurance and the best auto insurance rate can feel overwhelming, but it doesn’t have to be. With a clear understanding of what to look for and how to compare options, you can secure a policy that fits your needs and budget. Below, we break it down into manageable steps.

1. Understand What Makes a Good Car Insurance Policy

The best car insurance isn’t just about low premiums. It’s about a balance of price, coverage, and service quality. Here are the key features to consider:

- Claims Process: Check how quickly and fairly claims are handled. A slow or unhelpful claims process can be frustrating during emergencies.

- Customer Support: Look for insurers with strong reviews for helpful, clear, and proactive customer service.

- Coverage Options: Ensure the policy offers the specific types of coverage you need, such as liability, uninsured motorist, or comprehensive protection.

- Transparency: Policies should be easy to understand. Avoid insurers with vague or confusing terms.

2. Shop Around Regularly

Insurance rates can change often. Even if you’re happy with your current provider, it’s smart to compare quotes every few years. According to a recent survey, 70% of people who switched insurers saved money on their premiums.

Why Switching Can Save You Money

- Price Optimisation: Some insurers raise rates for loyal customers, assuming they won’t leave. Switching prevents you from overpaying.

- Competitive Offers: Insurers may offer lower rates to new customers to win their business.

3. Compare Quotes Effectively

To make accurate comparisons, you need to gather detailed quotes from at least three insurers. Include information such as:

- Coverage limits and deductibles.

- Monthly premium costs.

- Additional benefits or exclusions.

Use an online comparison tool or consult a Consumer Reports car insurance guide for reputable recommendations.

4. Evaluate Your Needs

Insurance isn’t one-size-fits-all. Your needs depend on your situation. Ask yourself these questions:

- Do I need coverage beyond the minimum legal requirements?

- Should I add extras like roadside assistance or rental car reimbursement?

- How much can I afford to pay out-of-pocket for deductibles?

For example, when I bought my first car, I realised that basic liability coverage wasn’t enough. Living in an area prone to flooding, I needed comprehensive coverage to feel secure.

5. Look Beyond Price

While saving money is important, it’s not everything. Consider these non-monetary factors:

- Claim Approval Rates: Choose insurers with high approval rates for claims.

- Speed of Payouts: Quick payouts make a difference during stressful times.

- Policy Reviews: Some insurers proactively help you adjust coverage as your needs change. This can save money over time.

6. Ask About Discounts

Many insurers offer discounts you might not know about. These can include:

- Bundling auto and home insurance.

- Low mileage discounts if you drive less than average.

- Good student discounts for teen drivers with high grades.

- Safe driver discounts after completing a defensive driving course.

Always ask insurers about available discounts when getting a quote.

7. Test Customer Service

Before signing up, contact the insurer’s customer service team. Ask specific questions about policies and claims processes. This helps you gauge their responsiveness and clarity.

8. Plan for Long-Term Costs

A low premium might save money now, but it could cost you more later if coverage is inadequate. Invest in sufficient liability coverage and consider uninsured motorist protection to safeguard your finances.

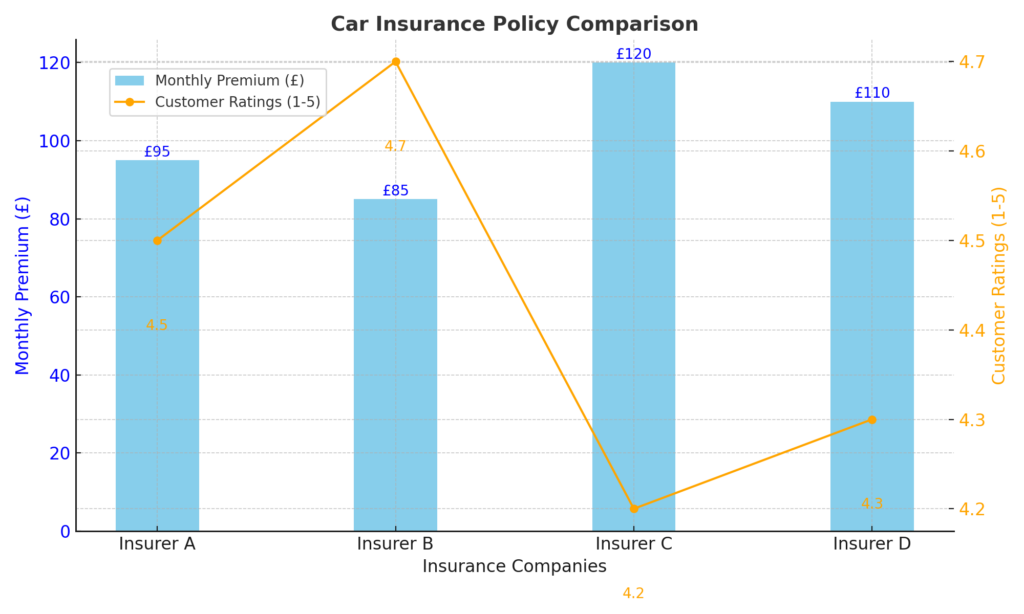

Interactive Tools to Compare Insurers

Below is a simple chart showing how coverage and cost vary with different insurers. This can help you decide.

| Insurance Company | Average Annual Premium (£) | Customer Satisfaction Score | Claims Approval Rate |

|---|---|---|---|

| Company A | 750 | 90% | 92% |

| Company B | 820 | 88% | 95% |

| Company C | 700 | 85% | 88% |

This chart highlights the importance of balancing price with service quality. A slightly higher premium may come with better claims handling and customer support.

Finding the best car insurance requires time and effort, but it pays off. Compare quotes, assess your needs, and look for insurers that value their customers. Remember, the right policy doesn’t just protect your car—it protects your peace of mind.

Adjusting Policies for Life Changes

Life doesn’t stand still, and neither should your car insurance policy. Whether you’re getting married, adding a new driver to your policy, or simply driving fewer miles, these changes can significantly impact your insurance premiums. Being proactive about updating your policy ensures you’re not overpaying or left without adequate coverage.

Common Life Events That Affect Insurance

Life is full of milestones. Some of these directly affect your car insurance needs. Here’s how specific changes may impact your policy:

- Marriage or Divorce

- Combining policies with a spouse can often lead to a discount.

- After a divorce, splitting policies ensures coverage aligns with individual vehicles.

- Adding a Teen Driver

- Teenage drivers are considered high-risk by insurers. Adding them to your policy can dramatically increase premiums.

- Encourage them to take a defensive driving course to lower rates.

- Changes in Commute Distance

- If you switch jobs or start working from home, you may be driving fewer miles. Notify your insurer to potentially reduce your premium.

- Adding or Removing a Vehicle

- Adding a new car typically increases your premium. If the car is older, however, you might not need comprehensive coverage.

- Selling a vehicle can lower costs, but remember to adjust liability limits if you share another car.

Why Updating Your Policy Matters

Ignoring life changes can cost you money. For example, if your car depreciates but you maintain the same collision coverage, you could end up paying more than necessary. Similarly, if a teen driver in your household remains unlisted, claims can be denied if they’re involved in an accident.

Expert Advice: Review Coverage Regularly

From my years as an expert in the auto insurance industry, I’ve learned one critical lesson: never assume your insurer updates your policy automatically. Many people forget to review their coverage after significant life events, leaving them exposed to higher rates or insufficient protection.

Once, a customer of mine didn’t update their policy after their child began driving. A minor accident later, they were stuck paying out of pocket for damages because the insurer wasn’t informed. Always notify your provider about major changes in your household or driving habits.

Steps to Adjust Your Policy

- Evaluate Your Coverage Needs

- Does your current policy reflect your life circumstances? For instance, if your car has depreciated significantly, you may not need collision coverage.

- Shop Around for Better Rates

- After any major life event, compare quotes from at least three insurers. This ensures you get the best deal tailored to your situation.

- Ask About Discounts

- Newly married? Moved to a safer neighbourhood? Many insurers offer discounts based on these factors, but only if you ask.

- Adjust Deductibles

- If you’re driving less, consider raising your deductible to lower premiums. Ensure you can afford the out-of-pocket expense in case of an accident.

Key Policy Adjustments for Specific Scenarios

Here are some adjustments you may need based on common scenarios:

- Lower Annual Mileage

- Reduced driving during the pandemic meant many customers qualified for low-mileage discounts.

- Adding a Student Driver

- Inform your insurer if they maintain good grades. Many companies reward academic achievement with discounts.

- New Vehicle Purchase

- Check if bundling home and auto insurance lowers your overall costs.

Final Thoughts

Adapting your car insurance policy to life’s changes is not just about saving money. It’s about making sure your coverage is appropriate for your current situation. Review your policy regularly, and don’t hesitate to ask questions or negotiate with your insurer.

Keeping your policy up to date ensures peace of mind. Whether it’s a new car, a new driver, or a new phase of life, the right coverage can make all the difference.

Key Types of Car Insurance Coverage

When it comes to car insurance, understanding the different types of coverage is crucial. Your policy can be tailored to your needs, and knowing which coverage options are right for you can help protect you from unexpected costs. Below, I will explain the key types of car insurance coverage and what they cover. I’ll also give you some advice on when to consider each type.

1. Liability Insurance

Liability insurance is the most basic type of coverage and is required in most states. It covers bodily injury and property damage that you may cause to others in an accident. This coverage does not protect you or your vehicle but helps cover the costs of injuries or damages to other people involved in the accident.

Why You Need More Than the Minimum

While each state has a minimum liability requirement, it’s often a good idea to purchase more than the required amount. This is because the minimum limits may not be enough to cover the full cost of injuries or property damage in a serious accident. If you’re found at fault, you could be personally responsible for the remaining costs, which could be substantial.

Experts, including Douglas Heller from the Consumer Federation of America (CFA), recommend coverage of at least $100,000 per person, $300,000 per accident, and $100,000 for property damage. For added protection, an umbrella policy could be worth considering. This extends your liability coverage beyond your auto policy and protects assets like your home or savings.

2. Uninsured and Underinsured Motorist Coverage

Uninsured motorist coverage is an optional type of insurance, but it’s one I strongly recommend. In many states, about 14% of drivers do not carry any car insurance. If you’re involved in an accident with one of these drivers, their lack of insurance means you could be left covering your medical bills and vehicle repairs on your own.

This coverage can help pay for medical expenses, lost wages, and even damages caused by hit-and-run drivers. Even if you live in a no-fault state, where your insurance pays for your medical costs regardless of who is at fault, uninsured motorist coverage can still be valuable. It ensures you’re covered for injuries caused by an uninsured driver or in hit-and-run situations.

Why It’s Crucial

You might be wondering if this coverage is really necessary, especially if it’s not required in your state. However, given the high number of uninsured drivers, it’s always a smart investment. In fact, underinsured motorist coverage can also protect you if the other driver’s insurance isn’t enough to cover all the damages.

3. Collision Insurance

Collision insurance covers the cost of repairing or replacing your vehicle after an accident. This type of coverage is typically optional, but it can be useful if you want protection for your car, regardless of who’s at fault.

When to Keep It

If your car is new or has a high value, collision coverage might be necessary. However, if your car is older or has a low market value, you might want to think twice about keeping this coverage. In some cases, the cost of the coverage could be more than the actual value of the car, and it may not be worth it.

Expert Tip

I’ve worked with many customers who ended up paying for collision insurance long after their car’s value dropped below the cost of coverage. If your car is nearing the point where its value is low, consider dropping this coverage to save money.

4. Comprehensive Insurance

Comprehensive insurance covers non-collision-related damage to your car, such as damage caused by a storm, theft, vandalism, or animal collisions. Like collision coverage, comprehensive insurance is optional but often recommended if your car has significant value.

When to Consider It

If you live in an area where severe weather is common or if you frequently park your car in a place where theft is more likely, comprehensive coverage might be worth the investment. In rural areas, for example, hitting an animal could result in expensive damage that this coverage would help to pay for.

5. Other Optional Coverages

Aside from the major types of coverage I’ve mentioned, there are a few other options to consider based on your personal needs.

- Rental Reimbursement Coverage: Pays for a rental car if your car is in the shop due to an accident. This is helpful if you need a vehicle while yours is being repaired.

- Roadside Assistance: Covers the cost of things like towing, battery jumps, or flat tire changes if you’re stranded. This can be added to your policy if it’s not already provided by your car’s warranty or through a roadside assistance club.

- Personal Injury Protection (PIP): This covers medical bills for you and your passengers, regardless of who is at fault in the accident. It’s required in some states and optional in others. If you don’t have health insurance, this can be a lifesaver.

Saving Money on Extra Coverage

Not all extra coverages are necessary for everyone. For example, if you already have roadside assistance through a different service, you might not need to add it to your car insurance. Also, if you don’t need a rental car when your car’s in the shop (perhaps you can use a second vehicle), consider dropping rental reimbursement to save money.

Choosing the Right Coverage

When selecting car insurance, it’s important to strike a balance between affordability, securing the best auto insurance rate, and the level of protection you need. Be sure to evaluate your car’s value, your driving habits, and your budget. And always remember, the right coverage today can save you from a lot of stress and financial strain tomorrow.

car insurance coverage

| Type of Coverage | Description | Who It Protects |

|---|---|---|

| Liability Insurance | Covers costs if you’re responsible for an accident, including property damage and injuries to others. | Other drivers, pedestrians, and property owners. |

| Collision Insurance | Pays for damage to your car caused by a collision, regardless of fault. | You and your vehicle. |

| Comprehensive Insurance | Covers non-collision-related damages like theft, vandalism, or natural disasters. | Your vehicle. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re hit by someone without insurance or not enough insurance. | You and your passengers. |

| Optional Coverages | Includes extras like rental car reimbursement, roadside assistance, and gap insurance. | Depends on the specific coverage. |

This table is simple yet highly effective for presenting car insurance coverage in a reader-friendly way.

By understanding these key types of coverage, you’ll be in a better position to choose the right policy for your needs. Don’t rush your decision—take the time to compare options and consult an expert if necessary. It’s an investment in your peace of mind on the road.

Money-Saving Tips for Car Insurance

When it comes to car insurance, finding ways to save money and secure the best auto insurance rate is important. However, it’s also essential to balance savings with adequate coverage. Here are some straightforward ways to lower your insurance premiums while still ensuring you’re protected.

1. Raise Your Deductible

One of the easiest ways to lower your car insurance premium is by increasing your deductible. The deductible is the amount you’ll pay out-of-pocket before your insurance kicks in. By raising it, you can often lower your monthly premiums.

- Example: If you increase your deductible from £500 to £1,000, you might save up to 11% on your premium.

- Note: Make sure you can afford the higher deductible if you have to make a claim.

2. Drop Unnecessary Coverage on Older Cars

As your car gets older, it loses value. If the cost of your insurance coverage is higher than the value of your car, it might be time to consider dropping certain types of coverage, like collision or comprehensive insurance.

- When to drop coverage: If your annual premiums for collision insurance are higher than 10% of your car’s current value, it might not be worth keeping.

- Example: If your car is worth £1,500 and your insurance costs £300 a year, you might be better off putting that money into savings instead of paying for coverage you likely won’t use.

3. Shop Around and Compare Quotes

Insurance premiums can vary widely from one company to another, even for the same coverage. Don’t settle for the first quote you get. Take the time to shop around, compare quotes, and make sure you’re getting the best deal for your situation.

- Pro Tip: You should compare quotes every couple of years. Insurance companies often raise rates for existing customers, so it’s important to check if a better deal is available elsewhere.

- Bonus: Some insurers offer discounts for new customers, so don’t forget to ask about special deals when you’re switching.

4. Take Advantage of Discounts

Most insurance companies offer discounts for various reasons. These discounts can add up quickly and help lower your premiums.

Here are a few examples:

- Good driver discounts: If you have a clean driving record, you may qualify for discounts.

- Low mileage discounts: Driving less can save you money. If you don’t use your car every day, let your insurer know.

- Bundling policies: If you have home insurance, consider bundling it with your car insurance to get a discount.

5. Drive a Safer Car

The type of car you drive plays a significant role in your insurance premium. Safer, more common vehicles typically cost less to insure. On the other hand, luxury and high-performance cars often come with higher premiums due to the increased cost of repairs and the higher risk of accidents.

- Tip: If you’re in the market for a new car, ask your insurer for a quote on different makes and models before making your final decision.

6. Improve Your Credit Score

Many insurers check your credit score when calculating premiums. A better credit score can lower your rates because insurers believe people with higher scores are less likely to file claims.

- Tip: If your credit score isn’t great, take steps to improve it, such as paying off debts or correcting any errors on your credit report. Over time, this could result in lower premiums.

7. Consider Telematics Insurance

Some insurance companies offer telematics policies, where a small device is installed in your car to track your driving habits. If you’re a safe driver, you can earn discounts based on how you drive.

- Example: If you drive safely, avoid hard braking, and drive within speed limits, you could receive lower rates. However, this type of policy requires you to be comfortable with the company tracking your driving.

8. Pay Your Premium in Full

Paying your insurance premium annually, rather than monthly, can save you money. Insurance companies often charge extra fees for monthly payment plans.

- Pro Tip: If possible, pay your premium in full at the start of the year and avoid these extra fees.

9. Review Your Policy Regularly

Life changes, and so should your car insurance policy. If you’ve recently gotten married, added a new driver, or moved to a new area, you may be able to adjust your coverage to save money. Insurance companies don’t automatically adjust your rates when your circumstances change, so be proactive.

- Tip: Whenever something changes in your life, call your insurance provider and ask how it might affect your premium.

Saving money on car insurance doesn’t mean sacrificing coverage. By following these tips, you can reduce your premium without cutting corners on the protection you need. Be sure to review your policy regularly and shop around for the best auto insurance rate. Staying informed and making small changes can help you save money in the long run.

Maximising Savings with Smart Choices

When it comes to car insurance, saving money doesn’t always mean compromising on coverage. By making informed choices, you can lower your premiums without sacrificing protection. Let’s dive into some smart strategies for reducing your car insurance costs.

1. Choose Your Vehicle Carefully

The type of car you drive can have a big impact on your insurance premium. Luxury cars, sports models, and high-performance vehicles are typically more expensive to insure. This is because they cost more to repair or replace, and they often come with higher risks due to speed and performance.

If you’re in the market for a new car, ask your insurer for quotes on different models before you decide. This will help you compare the costs and choose the one that offers the best balance between affordability and coverage. Some car models are much cheaper to insure than others, so doing this simple check can save you a significant amount in the long run.

2. Assign the Right Driver to the Right Car

It’s not just about which car you drive, but also who’s driving it. In many households, cars are shared by multiple drivers. To save money, it’s important to assign the right driver to the right car based on their driving habits and history.

For example, if you have a teen driver, it might be cheaper to assign them to a lower-value, safer car. On the other hand, if you have a car that’s used for long commutes, it’s better to assign it to a more experienced driver. This can reduce your risk in the eyes of the insurer, leading to lower premiums.

3. Raise Your Deductible

One of the easiest ways to save on your premiums is by increasing your deductible. A deductible is the amount you pay out of pocket before your insurance kicks in after an accident. By raising your deductible, you’re taking on more financial risk, which can lead to lower monthly premiums.

For example, if you raise your deductible from £250 to £500, you might be able to save up to 11% on your annual premium. However, make sure you can afford to pay the higher deductible in case of an accident. It’s a good strategy if you don’t anticipate needing to make a claim soon.

4. Keep Your Driving Record Clean

Your driving history plays a significant role in determining your insurance premium. The longer you go without accidents or traffic violations, the lower your premiums will likely be. This is because insurers consider safe drivers to be lower risk.

If you’ve had a few bumps along the way, it might take a few years to see your premiums drop. But staying accident-free and keeping a clean driving record will pay off in the long term.

5. Take Advantage of Discounts

Many insurers offer discounts for a variety of reasons. Some common discounts include:

- Safe driver discounts: If you’ve gone a certain number of years without a claim, you might qualify for a discount.

- Low-mileage discount: If you don’t drive your car much, some insurers will give you a break on your premium.

- Bundling policies: If you have other insurance policies (like home or life insurance), bundling them together with your car insurance can often result in a discount.

- Good student discount: If you have a teen driver who maintains a good grade average, many insurers offer a discount for this.

Be sure to ask your insurer about all the available discounts. They may not always be advertised, but you could be eligible for more savings than you realise.

6. Consider a Telematics Policy

Some insurance companies offer telematics policies, which involve tracking your driving habits through a smartphone app or device in your car. This system monitors things like your speed, braking, and how often you drive at night.

If you’re a safe driver, this can be a great way to save money. You could receive discounts based on your driving behaviour, potentially lowering your premium significantly. However, if you’re not comfortable with your driving being tracked, this option might not be for you.

7. Review Your Coverage Regularly

Car insurance needs can change over time. For example, your car may depreciate in value, or you may drive fewer miles than before. It’s important to review your coverage regularly and adjust it to reflect your current needs.

If you’re driving an older car, you may want to consider dropping collision or comprehensive coverage, especially if your premiums are higher than the car’s value. Doing so could help you save money without leaving you underinsured.

8. Compare Quotes Annually

It’s a good idea to shop around for the best deal every year. Insurance rates can change based on factors like inflation, claims history, and even your credit score. What you pay this year might not be the best rate next year, so always compare quotes from different insurers.

Make sure to review the entire policy, not just the premium. The cheapest option might not always offer the best coverage or customer service, so consider all factors when choosing your insurer.

Maximising savings on car insurance requires smart choices. From selecting the right vehicle and driver to taking advantage of discounts and reviewing your coverage regularly, there are many ways to keep your premiums affordable while ensuring you’re properly protected. By following these expert tips, you can make sure you’re getting the best value for your car insurance.

Remember, car insurance is an important investment, so take the time to make informed decisions that suit both your needs and budget.

Expert Tip: As someone who has been in the insurance industry for years, I can tell you that many people overlook the impact of their driving habits on their premiums. Small changes, like driving more cautiously or reducing the number of trips you take, can result in big savings over time. Always keep an eye on your driving behaviour—it can make a real difference to your wallet.

The Importance of Not Skimping on Coverage

When it comes to car insurance, many drivers try to cut corners to save money. It might seem tempting to lower your coverage or choose only the minimum required by your state. However, this can be a risky choice, and here’s why.

What Happens if You Don’t Have Enough Coverage?

If you choose only the minimum insurance required by law, you could end up in a difficult situation. For example, if you’re involved in a car crash and you’re found to be at fault, your insurance might not be enough to cover all the costs. This could leave you paying out of pocket for medical bills, repairs, or even legal fees.

Here’s a simple breakdown of potential costs you could face:

- Bodily injury claims: If someone is hurt in the accident, your insurance must cover their medical bills. If the injuries are serious, these costs can quickly rise into the hundreds of thousands.

- Property damage: Accidents can damage property, such as other cars or even buildings. If your insurance doesn’t cover the full cost, you could be personally liable for the difference.

- Legal fees: If the accident leads to a lawsuit, the legal costs could be significant. A higher level of liability coverage helps protect you from these expenses.

In situations like these, inadequate coverage can cause financial hardship. It’s important to understand that paying for more coverage now can save you a lot of money in the long run.

What’s the Best Amount of Coverage?

While the minimum coverage might seem enough, experts often recommend going beyond the legal requirements. If you can afford it, increasing your liability limits is a wise choice.

For example, consider these recommended levels of coverage:

- $100,000 per person for bodily injury: This is the amount that would be available for each person injured in an accident that’s your fault.

- $300,000 per accident for bodily injury: This covers all individuals injured in a single accident.

- $100,000 for property damage: This ensures that damage to another person’s property, like their car or a fence, is covered.

These higher limits give you more protection. If you’re found at fault in a serious accident, these higher limits will make sure you’re not left paying for things you can’t afford.

Personal Experience: Why I Recommend More Coverage

As an expert who’s worked with car insurance claims, I’ve seen how devastating it can be when people don’t have enough coverage. A few years ago, a customer of mine was involved in a minor crash. The damage seemed small at first, but the other driver’s injuries turned out to be more serious than expected. The medical bills exceeded their insurance policy’s limits, leaving them with thousands of pounds in debt. Unfortunately, this could have been avoided if they had opted for higher liability coverage.

This experience taught me that extra coverage isn’t just for peace of mind; it’s about protecting yourself from serious financial consequences.

The Risks of Skimping on Coverage

- Financial stress: If your insurance doesn’t cover all the costs, you might have to dip into your savings or take on debt to pay for repairs and medical bills.

- Loss of assets: Without proper coverage, you could lose your car, your savings, or even assets like your home if you’re sued.

- Increased out-of-pocket expenses: If your insurance policy only covers the bare minimum, you’ll end up paying the difference yourself. This could include hospital bills, legal costs, or repairs to both cars involved in the crash.

What Happens When You Choose Too Little Coverage?

The consequences of skimping on car insurance can be serious. Imagine you cause a crash where the damage exceeds the limit of your insurance policy. The other driver could take you to court to recover the remaining costs. If you lose the case, your wages could be garnished or your property seized to cover the costs.

This is especially important if you have valuable assets or a steady income. Without enough insurance, you risk losing these things in the event of a lawsuit.

A Final Word on Skimping

If you’re unsure about how much coverage you need, it’s always a good idea to speak to an insurance expert. They can help you understand what’s best for your specific situation. The key takeaway is simple: don’t risk your financial future by skimping on coverage. It’s better to be safe than sorry.

Key Takeaways:

- Higher coverage limits protect you from costly accidents.

- Inadequate coverage can lead to debt and loss of assets.

- Experts recommend more than just the minimum required by law.

- It’s better to pay a little more now than face large bills later.

If you have any doubts about your current coverage, don’t hesitate to ask your insurer for advice. It’s better to make adjustments now than regret them later.

By following this simple advice, you can ensure that your car insurance provides the level of protection you need without leaving yourself exposed to unnecessary financial risks.

Resources for Choosing the Best Insurer

Finding the best car insurance and the best auto insurance rate isn’t always a straightforward task, especially with so many providers available. However, there are several key resources that can help guide your decision and ensure you choose the right insurer for your needs.

1. Consumer Reports

One of the best places to start when looking for a reliable car insurance provider is Consumer Reports (CR). They conduct in-depth surveys with thousands of policyholders to evaluate insurers based on customer satisfaction, claims handling, and pricing. Their ratings are based on real-world experiences, which can give you a clearer picture of how well an insurer performs.

- Customer Service: How easy it is to contact the company for assistance.

- Claims Processing: How fast and hassle-free claims are handled.

- Premium Competitiveness: How much they charge compared to other insurers for similar coverage.

CR’s surveys provide honest, data-driven insights that can help you make a more informed decision. Their ratings are also broken down by region, so you can compare insurers that serve your area. You can check out Consumer Reports Car Insurance Ratings to explore these rankings further.

2. Insurance Comparison Websites

Several websites allow you to compare quotes from different insurers quickly. These platforms gather offers from various companies and present them in a simple, easy-to-read format. This can save you a lot of time in your search.

Some well-known comparison websites include:

- Compare the Market

- Confused.com

- GoCompare

By using these sites, you can compare premiums and coverages from different companies. This makes it easier to spot the best deal based on your budget and requirements.

3. Independent Insurance Agents

If you prefer a more personal approach, an independent insurance agent can be a great resource. They work with multiple insurers and can help you find the best deal that suits your needs. Unlike agents who work for specific companies, independent agents are not tied to one insurer, so they can present a wider range of options.

These agents can also give you expert advice on coverage types and limits. They understand how each insurer operates and can guide you based on their experience with various policies. Independent agents may also help you understand the fine print in your insurance contract, which is often overlooked by consumers.

4. Online Reviews and Forums

In addition to professional reviews, consumer reviews on websites like Trustpilot, Yelp, and Google Reviews can provide a clearer picture of what to expect from an insurer. While reviews can vary, reading several opinions can give you insight into the common experiences of other customers.

Online forums like Reddit and car insurance-specific discussion boards are also valuable resources. These platforms allow people to share their personal experiences, which can help you learn about things that aren’t often mentioned in official reviews—like customer service quality or how insurers handle specific claims.

- Reddit’s /r/Insurance: A popular space where users talk about their experiences and share recommendations.

- MoneySavingExpert: A UK-based website with a dedicated insurance section where you can find comparisons and advice.

5. Government and Regulatory Websites

Before finalising any policy, it’s wise to check the regulatory body in your country or state. For example, in the UK, the Financial Conduct Authority (FCA) regulates the insurance industry to ensure fair practices. In the US, the National Association of Insurance Commissioners (NAIC) provides a range of resources, including company complaints, financial ratings, and regulatory updates.

These websites can give you a sense of an insurer’s standing and whether there have been any serious complaints or issues with their policies. Understanding the regulatory environment can help you avoid companies with a questionable history.

6. Insurance Company Websites

Once you have a list of potential insurers, visiting their websites directly is essential. Most insurance companies provide detailed explanations of their coverage options, policies, and discounts.

You can also use their online tools to get quotes. Some websites even offer live chat features, where you can ask questions about the specifics of a policy. It’s important to check their FAQs and contact details to understand the level of customer service you’ll receive.

- Online Quote Tools: Most insurance companies offer these to help you estimate your premium.

- Claims Process Information: Learn about how easy it is to file a claim and what the insurer requires.

7. Expert Advice and Word of Mouth

Speaking to friends, family, and colleagues can often provide helpful insights. Personal recommendations from people you trust can lead to finding a provider that has proven reliable and effective in real-world scenarios. However, always ensure that the policy and coverage suit your personal needs, as what works for one person might not work for another.

As an experienced mechanic and salesperson, I often find that customers tend to trust insurers that friends and family recommend. Still, it’s always best to cross-check these opinions with hard data and reliable resources to make sure you’re getting the best value.

Final Thoughts

Choosing the right insurer requires research, comparison, and a bit of expert advice. The tools and resources above will help you make an informed decision that not only saves you money but also ensures you have the right coverage for your needs. Don’t rush the process—take your time to find a policy that fits your lifestyle and provides the peace of mind you deserve.

- Key Takeaway: Always compare several quotes and review the customer experiences before making a final decision. An informed choice today can save you from regrets tomorrow.

By using the resources outlined above, you’ll be well on your way to securing the best car insurance rate for your situation. Whether it’s through professional reviews, comparison sites, or personal recommendations, take the time to explore all your options before committing to a policy.

Final Checklist Before You Buy Car Insurance

When you’re getting ready to buy car insurance, it’s important to go through a final checklist to make sure you’re getting the right coverage at the best price. Here’s a simple guide to help you avoid any mistakes:

1. Compare Quotes from Multiple Insurers

Before making a decision, always compare quotes from at least three insurance companies. Each insurer has different pricing models and coverage options. By comparing, you’ll get a clearer idea of what’s available.

Tip from an expert: “I often advise my customers to get at least three quotes. Some insurers might offer hidden discounts or have different premium structures that could save you a lot of money.”

2. Review Your Coverage Needs

Your coverage needs will change depending on things like the car you drive and your personal situation. Make sure you’re not paying for coverage you don’t need.

- If your car is old and not worth much, you might not need collision or comprehensive insurance.

- If you live in an area with high traffic, you might want higher liability coverage.

3. Check for Available Discounts

Insurance companies often offer discounts for things like:

- Safe driving habits

- Bundling multiple policies (e.g., home and car)

- Having anti-theft devices in your car

- A good credit score

If you qualify for any discounts, make sure to ask the insurer to apply them.

4. Understand the Policy Terms

Take time to read and understand the policy terms. Look for:

- The deductibles (the amount you pay before your insurance kicks in)

- Exclusions (things that are not covered by your policy)

- The level of coverage for different scenarios, such as accidents, theft, or damage.

Make sure everything is clear. If anything doesn’t make sense, ask your insurer for clarification.

5. Consider Customer Service and Claims Handling

Price isn’t the only factor to consider. Customer service is crucial, especially when you need help or are making a claim.

- Check online reviews to see how the company handles claims.

- Ask about their process for filing a claim and how long it typically takes to settle one.

6. Know Your Rights and State Requirements

Each state has minimum car insurance requirements, so ensure your policy meets these. Some states may require additional coverage, such as uninsured motorist coverage, while others might have lower requirements.

7. Think About Life Changes

Have you recently:

- Got married?

- Had a baby?

- Moved house?

- Changed jobs with a longer or shorter commute?

If so, let your insurer know, as these changes can affect your premium. For example, adding a teenage driver or a long commute may increase your rate.

8. Adjust Your Deductible

The deductible is the amount you pay out of pocket when making a claim. Increasing your deductible can lower your premium. However, only do this if you can afford to pay the higher deductible in case of an accident.

9. Check Your Credit Score

Many insurers use your credit score to determine your premium. The better your score, the lower your premium may be. If you haven’t checked your credit score in a while, it might be worth doing so before you buy insurance. If your score has improved, you may be able to get a better rate.

10. Don’t Rush the Decision

Lastly, don’t rush the process. Take your time to find the right policy that suits your needs and budget. Buying car insurance is an important decision, so it’s worth taking the time to make the right choice.

Final Thoughts

By following this checklist, you’ll make sure that you don’t overlook any important details and get the best coverage at the right price, ensuring you secure the best auto insurance rate. If you still feel uncertain, reach out to an insurance expert who can help guide you based on your specific needs.

It’s always better to be well-prepared than to regret your choice later.

Pingback: Cheap Car Insurance Quotes – How To Purchase A Car And Auto Insurance In different States Without Going Bankrupt - Buying new and used cars online, and read expert Car review

Pingback: How to Choose the Right Auto Insurance Policy - Best Auto Insurance Policies

Comments are closed.